Innovative Ideas and Strategies for Aeronautical Success

Aviation Career

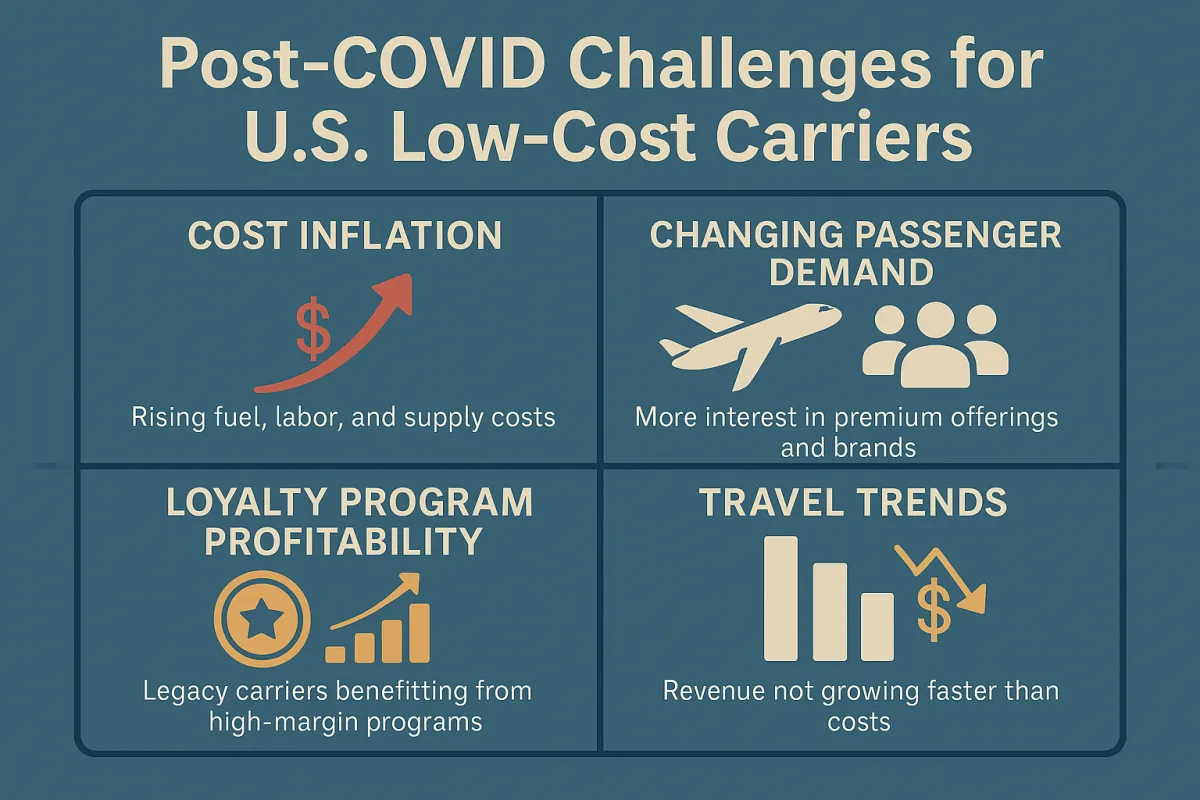

Why U.S. Low-Cost Carriers Are Struggling to Succeed Post-COVID

1. Cost Inflation: The Squeeze That Outpaced Fare Growth

Since the pandemic, inflation hasn’t just burdened consumers—it’s also significantly raised airlines’ cost bases. Fuel, maintenance, airport fees, labor, and supply chain expenses have all soared. Even if wages have inched upward for individuals, as most us have experienced, our rising costs for groceries, rent, and services often outstrip those gains. The same dynamic is at play in the airline industry—profits are being eaten away by relentless cost increases that ticket prices can’t fully offset.

Although airlines are reporting record revenues, soaring operational costs have simultaneously surged, muting profits. This mirrors what many individuals feel: even with higher pay, balancing a budget remains a struggle when expenses climb faster.

2. Loyalty Programs: The Real Profit Centers

Major U.S. airlines have leaned more heavily on loyalty programs for profitability. As shown in Visual Approach Analytics’ 2024 analysis, none of the network carriers—Delta, United, American, Alaska, or even Southwest—would have been profitable from core ticket sales alone. Remove loyalty revenue, and their operating margins turn negative:

Delta: from +10.5% to –2.5%

United: from +8.9% to –1.9%

American: from +4.8% to –8.3%

Alaska: from +4.9% to –11.4%

Southwest: from +1.2% to –19.9% One Mile at a Time

These loyalty programs—driven by co-brand credit cards, mileage sales, and partner revenue—deliver EBITDA margins in the 30–40% range, per Platform Aeronaut’s breakdown of United’s MileagePlus economic performance.

3. Low-Cost Carriers’ Models Leave Them Exposed

ULCCs and low-cost carriers—Spirit, Frontier, JetBlue, Southwest—have long thrived on ultra-lean fare-based business models. But those same models today are a liability:

Limited Loyalty Revenue: They lack the deep, high-margin loyalty ecosystems of legacy giants. Frontier is attempting to pivot—promising to grow loyalty revenue from $6 per passenger in 2026 to $10 by 2028 and rolling out instant status perks and an “all-you-can-fly” pass ReutersYahoo FinanceWikipedia.

Negative Margins: Spirit, for instance, posted a –22.5% operating margin for 2024 InvestopediaReuters. Its financial trajectory remains precarious, with a second Chapter 11 bankruptcy, massive losses, and warnings of possible collapse within a year New York PostReuters.

Demand Shifts: Price-sensitive leisure travelers remain soft. Budget airlines that can't offset cost growth with premium-product premiums are struggling. Business Insider notes that while full-service airlines benefit from premium and international demand, budget carriers continue to lag Business Insider.

Competition and Fatigue: Bloomberg reports that ULCCs face fierce competition from legacy carriers offering deeply discounted “basic economy” fares, compounding financial stress Bloomberg.com.

4. A Comparison with Legacy Carriers

Legacy airlines have multiple advantages to offset inflation:

Loyalty Ecosystems with Deep Margins: Loyalty programs account for a large chunk of their enterprise value—platforms like MileagePlus not only drive steady high-margin income but also underpin valuations .

Pricing Power & Premium Travel: With multiclass product offerings and strong business travel demand, long-haul routes, and premium segments, legacy carriers can grow revenue above inflation—a lever low-cost carriers lack Business InsiderThe Mighty 790 KFGO | KFGO.

Bigger Scale & Brand Resilience: When ULCCs like Spirit collapse or retrench (as seen recently), legacy or larger LCC carriers step in and gain market share. Following Spirit’s bankruptcy, Frontier’s stock surged on expectations it would pick up routes, but analysts still favor dominant legacy carriers for long-term stability Barron'sReutersMarketWatch.

Operational Reliability: Customers and corporate buyers trust legacy carriers more, and they often offer more consistent service—even at lower prices when needed Barron's.

5. In Summary: Why ULCCs Are Behind—And What Winners Look Like

ULCCs’ lean fare-focused model lacks margin flexibility. With cost inflation, ticket price hikes alone can’t restore profitability.

Loyalty program revenue is a game-changer. Legacy carriers benefit from high-margin programs that low-cost airlines either lack or are only starting to develop.

Shifts in passenger demand favor premium & loyal-brand offerings. Individual travelers, similar to airlines, may have more income but less willingness to compromise—creating demand for value, reliability, and rewards.

Brand, scale, and market power matter. Airlines with strong brands, broader networks, loyalty ecosystems, and pricing versatility are best positioned to turn revenue growth into sustained profit in today’s inflationary, competitive market.

Conclusion

As we’ve seen, the post-COVID environment—marked by stubborn inflation, evolving traveler behavior, and economic pressures—has exposed structural weaknesses in the low-cost carrier model. Unlike legacy airlines, ULCCs haven’t been able to generate loyalty-program income that outpaces cost inflation. Spiraling margins, even amid record revenues, reflect this gap.

Ultimately, the winners in the U.S. airline industry will be those with brand strength, scale, pricing power, diversified revenue streams, and resilient loyalty programs—attributes that allow revenue to grow faster than costs. As individuals know all too well when juggling rising household expenses, having flexibility, multiple income streams (or rewards), and a trusted brand makes all the difference.

Every great aviation career starts with confidence — in your skills, your story, and your interview. Let AVIC help you put it all together. Connect with our team today to start preparing for your next opportunity.

STAY BRIEFED

Sign up to be the first to find out when something new lands:

-Events

-Articles

-Podcast

-Courses

Large Call to Action Headline

A-V-I-C stands for Aviation Intelligence Community. Our mission is to improve the quality of life for aviators through shared experience. Be sure to join us on the social media sites @avicair, we love sharing ideas, experience, and intelligence to propel our industry forward.

Facebook

Instagram

X

LinkedIn

Youtube